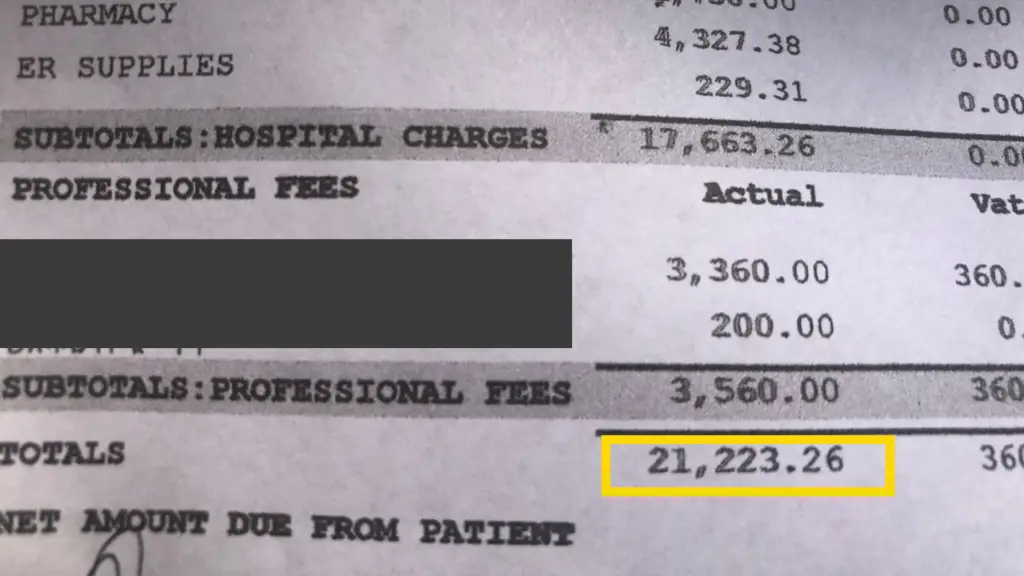

PHP21,223.26…

That’s the amount reflected on my hospital bill.

Whew! That’s the amount I have to pay for staying at the hospital for 3 days.

If I didn’t save up enough money for my emergency fund, I don’t know where to get the money to pay for that hospital expense.

Inspired by this experience (my very first hospitalization), I want to share with you how important having an emergency fund is.

Table of Contents

What Is an Emergency Fund?

An emergency fund is simply cash that you saved up to cover life’s unexpected expenses such as unforeseen medical bills.

Why Do I Need an Emergency Fund?

It’s simple… You need an emergency fund because you don’t know what will happen.

If there’s one thing we can learn from the 2020 global pandemic, it is to save up as much as we can so that when disasters come, we’ll be at ease that we have a stash of cash to spend on our needs.

By keeping an emergency fund –even a small amount, it will be quicker to recover from unplanned expenses.

How Much Money Should I Have in an Emergency Fund?

The amount you need to save as your emergency fund depends on your circumstances. But a good rule of thumb is to set aside an amount to cover at least 3 months’ worth of your living expenses.

So, let’s say you spend PHP20,000 monthly on rent, groceries, etc, then try to save at least PHP60,000 (that’s 3 months of your living expenses).

The goal here is to save as much as money you can to pay for any expenses/bills that may come your way at the most unexpected time and place.

Where Should I Keep My Emergency Fund?

Because an emergency can strike anytime and anywhere, you should keep your emergency fund in a place where you can access it anytime and anywhere.

With that, I recommend keeping your emergency fund in a digital bank such as CIMB Bank. I save my emergency fund in my CIMB bank because aside from I have quick access to it, it is also earning monthly interest.

Related: 5 Digital Banks in The Philippines

However, if you are not a fan of digital banks, you can just deposit your emergency fund in a traditional bank. Just make sure that you kept it separately from your other savings account so that you can manage it easily.

How Do I Build an Emergency Fund?

There are different strategies to get your savings started. But here are a few ways I did to save for my emergency fund.

1. Determine The Amount You Need To Save

By deciding how much you need to save as your emergency fund, it will be easier to set monthly saving goals.

So what I did was to calculate my monthly living expenses (which was around PHP15,000/month) and then I multiplied that by 6 months. With that, my main savings goal is PHP90,000.

2. Set a Monthly Savings Goal

After determining the whole amount you need to save up for your emergency fund, it is now time to set how much you need to save every month.

I wrote a blog discussing how much you should save from your paycheck. In that article, I recommend setting aside 20% of your monthly salary as your savings. However, if you think you can save more or less than this, that’s also fine.

The most important thing here is that you will consistently save a certain amount every month.

3. Assess and Adjust How Much You Save

You must keep track of your savings each month. If for instance, you were able to reach your main savings goal within a few months, then you might need to look for other opportunities to park your money.

What I did when I reached PHP90,000 in my CIMB bank, I still kept adding every month. When I reached PHP150,000, I opened a Security Bank savings account and deposited PHP60,000, which I used as a security deposit to avail a secured credit card from the bank.

When Should I Use My Emergency Fund?

Not every unexpected expense is an emergency. Set some guidelines for you to determine what an emergency is and what’s not – and be consistent.

In addition, do not be afraid to use your emergency fund if you really NEED to. If you spend a portion of your emergency saving account, just make sure to build it up again.

Final Words

Saving up for an emergency fund is one important way to deal with unanticipated expenses. Having reserved cash gives you peace of mind that whatever unplanned expenses you’ll have in the future, you can quickly recover from them.

Now that you learned what an emergency fund is, how important it is, and how to build it, start saving for it.